StartInvoice FAQ - Online invoicing and warehouse

Start working with StartInvoice - online billing software and storage

Can StartInvoice completely replace the invoices issued by the cob?

Yes, you. StartInvoice has all the attributes of an invoice as described in the Accountancy Act art. 7 (1) VAT Act and art. 114 (1).

it allowed the use of invoice without signature and seal?

Yes, that is allowed in January 2011 by the Accounting Act eliminated art. 8, which imposes some restrictions on the documents. At the time signature, identification code and the stamp is not present in the required attributes of art. 7 of the Law on Accounting and art. 114 (1), (6) of VATA

What will happen with online invoices issued by StartInvoice?

They are official documents proving the payment to your company and the options are as follows:

- Or

- electronic invoices by bank transfer : You can send them electronically to their customers to implement them in their accounts. Sending is carried out by StartInvoice and in two ways:

- as PDF document , attached to e-Mail to your customers and

- as Link (link) , in which the visit, the client gets access to your electronic invoices for printing and recording on your computer

Or

- electronic invoices in Number:

You can print them and you give them to customers, along with the receipt or you can just give them a receipt, invoice and send it to them via email and they are to printed if they decide to implement it before in my accounting.

What to do to start working with StartInvoice? Immediately!

You must register to www.startinvoice.com , where you can enter your data for invoices and their starting number.

Daily work withStartInvoice - online invoicing and storage systems

How to introduce new customers?

This can happen in two ways:

- Automatically add new customers in the process of completing the document - when you fill in the fields of counterparty StartInvoice will check your database if it exists, and if it finds will add it automatically when storing documents in your customer lists and suppliers. Furthermore, it will automatically add all these fields (list boxes) all new, which fill in the time of document storage.

- complement nomenclature with new customers and through you a choice of menu lists -> Customers and suppliers. They add new contractors by clicking New , then fill the data associated with it.

How to introduce a new beneficiary of my invoice?

This also happens in two ways, as when a new client:

- Automatically add new recipients in the process of completing the document by StartInvoice will add to the moment save the document with the Save button .

- to add new recipients to the nomenclature by their choice of menu lists -> Customers and Suppliers. In this code you stand contractors, together with their representatives (recipients).

, through which all show representatives of that company from you. Adding a new recipient is a key New and fill the data associated with it.

, through which all show representatives of that company from you. Adding a new recipient is a key New and fill the data associated with it.

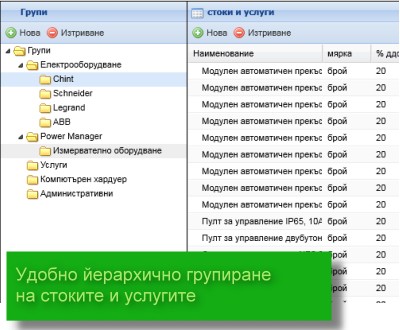

How to introduce new products / services?

- Automatically add new items in the process of completing the document by StartInvoice will add to your list of goods and services at the moment save the document.

- to add new products and services in the nomenclature through selection of menu lists -> Goods and services which will add a new button New and fill the data related .

How to bring more customers / staff to issue invoices?

Adding more users of the system is done from the menu Settings -> Users, which will add a new button Add and fill the data related .

How to betraySimplified invoice?

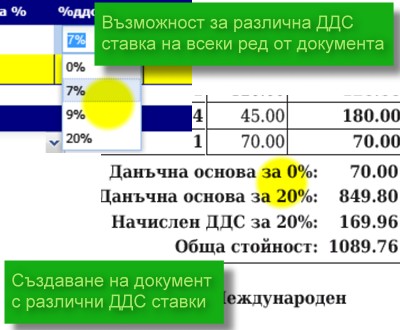

If you are not registered for VAT invoice or prepare for a foreign person can do in the following ways:

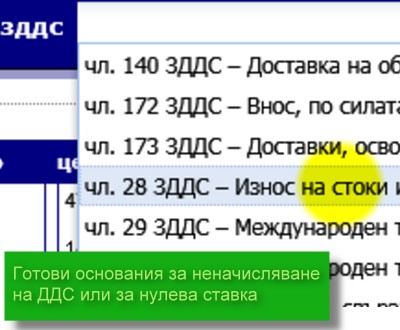

- For companies registered for VAT or sold goods zero VAT rate - in the "Standard% tax" on Settings menu -> Profile appears 0 and checks to the default reason for zero if it is valid for your company. With the release of documents involving products / services with zero rate - will automatically appear in the drop-down list ready "Grounds for not charging VAT" , from which the user if he can choose another basis - member VAT, relied on.

- For companies issuing documents different VAT rate in the "Standard% tax" from the menu Settings -> Profile appears they are using a percentage.

- For companies in some cases a zero or different from the standard rate at which a company operates - the introduction of the document in the "% VAT" of the item can be selected % of another list. When issuing a document with the participation of such item, the program will charge a different rate of VAT on its series, and for other articles that will charge for "Standard% tax" from the menu Settings -> Profile.

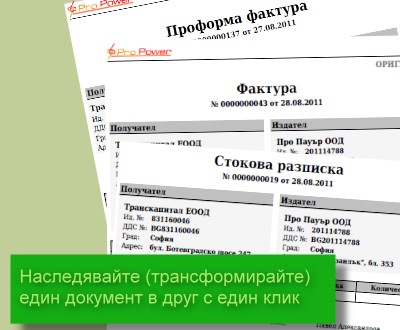

What is the difference between sending a PDF document and send the document with the notification?

Save & Send PDF document - sending an E-mail as a PDF file that is attached in the email to your client. Once you get it you can print and store on your computer.

Save & Send notification document - sending an E-mail a Link in an email to your client. By visiting the link, the customer can print or save the document to your computer . The key point in this method is to obtain confirmation of name, date and time that the client has received the document.

How to move between fields during the filling of documents StartInvoice?

movement can be done in two ways:

- the mouse - clicking in a field

- by key Tab - to move forward and keys Shift + Tab - to move backwards

How to understand what the icons used in StartInvoice?

StartInvoice use predictive text that appears when pointing the mouse on a field, icon, button, link, which is what is their purpose.

How to open the Info panel?

Information display system is displayed by clicking the logo